will the 'Greferendum' lead to a 'Grexit'? - what next for Greece?

- Expat Advisory Group

- Jul 3, 2015

- 4 min read

Greece defaulted on its payments back to the IMF and joined the ranks of Zimbabwe and Sudan, and its European bailout expired. Not a great day! The failed payment of $1.7 billion to the global lender of last resort meant that Greece became the first advanced economy to default. Alexis Tsipras, the Greek Premier called for a referendum, to be held on 5th July on further budget cuts and austerity proposals.

Tsipras unexpectedly called for the vote last weekend, just as talks with creditors broke down, and the rhetoric out of Athens was that 'The Show Must Go On'. Hardly. Multiple EU officials were quick to bluntly state that no further discussions were possible until after the referendum was complete. Merkel didn't mince her words with the German press saying "We'll negotiate absolutely nothing before the planned referendum is held".

One of the main questions is what exactly are Greek voters voting on? It's especially unclear given that the last creditor proposal is now null and void, technically speaking anyway! Political progress and negotiations have been in a strange state of limbo all week, just waiting for Sunday, while stocks have been very volatile. European stocks have gone up then down then up then down then up then down again. The Euro Stoxx 50 is currently at 3,463.25 which isn't much different to Monday.

Anyway, whilst we're not really clear what the referendum is specifically on, it will effectively be a vote as to whether or not to stay in Euro, and to decide Tsipras's future. At least with the referendum, there should be a bit more clarity.

So what next? If there's a 'No' or a 'yes', here are some thoughts:

No Vote: There has never been an exit from the Euro, and there is no real established process that's clear in any Euro treaties. Yet this is exactly the most likely outcome if Greek voters reject the creditors' proposals. This will be unknown territory. The Greeks will have very little negotiation power and creditors' patience, not just in Germany, is already on the brink. Greece needs probably in the region of $40 billion in total support still, as well as easier terms on outstanding debt to keep finances manageable. Greece leaving the Euro, might actually see the Euro strengthen in the short term. The derogatory term 'PIGS', originally coined in the 1990s, but popularised during the more recent European Debt Crisis, stands for Portugal Italy Greece Spain. The potential fear could be the knock on effect. If Greece defaults and leaves the Euro, what then for the others? You're left with only the PIS from the PIGS!

Yes Vote: Some form of new bailout package would arrive. With the support of the Greek people, negotiations on a fresh bailout can quickly re-start. But, without Tsipras! He has always been campaigning for a 'No'. He even said on Tuesday "If the people vote yes, then the referendum outcome will be completely respected, but I will not serve". With a 'Yes' it seems highly unlikely the Greeks would leave the Euro. In the context of a 'Yes' vote, Greece exiting, whoever triggered it, would be a disastrous scenario. With the Greeks effectively voting to find a way to stay in the Euro, an exit would put a question mark on the democratic foundations of the whole Euro project.

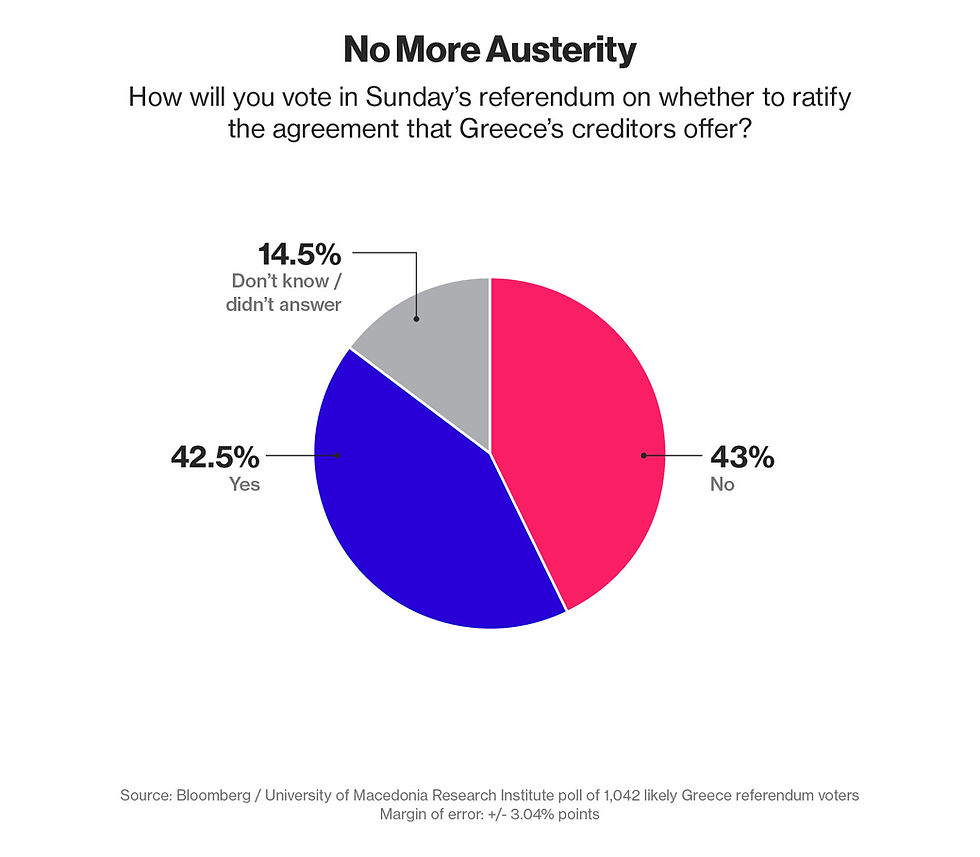

We shall see! Currently the opinion polls show a real split with reference to austerity. Below is from a recent opinion poll from the University of Macedonia, commissioned by Bloomberg showing an almost even split.

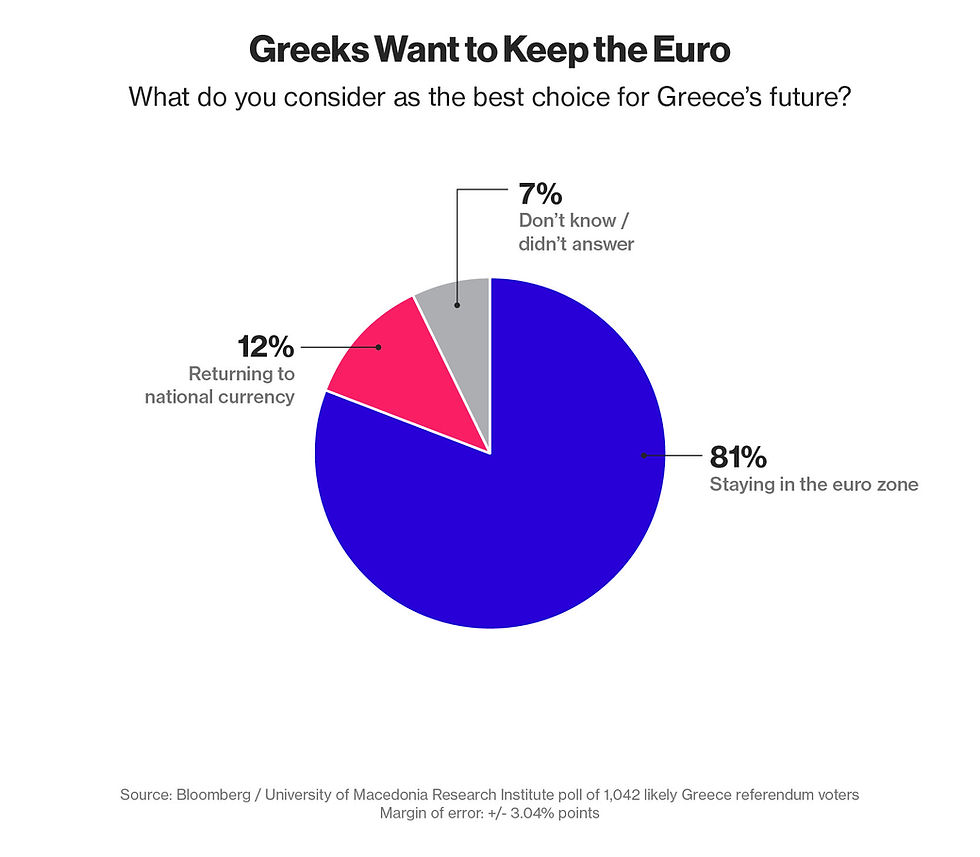

From the same opinion polls, views on staying in the Euro look fairly definitive!

Anyway, I guess we have to wait until Sunday, however, what is actually the best outcome? There's part of me that says Greece leaving the Euro and trying to rebuild on their own, their own way, is best long term for everyone. Then again as a student, I was an anti-Euro (Conservative) Brit, and I still really don't see how it all works! Either way, in or out, there will be many more twists and turns and it's essential investors have their portfolio adequately positioned. There's a lot of debt and aid potentially on the table - ECB and Eurozone aid and bailouts, IMF help, but then what? More debts are due, and whilst tiny in proportion, there is a 20 billion Yen Samurai bond that needs repaying on July 14th. It's one thing to miss an IMF payment, it's another thing altogether in this scenario as a Samurai bond is a marketable debt instrument - if it isn't paid it could cause a cross default on other public bonds! The wide-spread ramifications of this are not very good at all. That's why ultimately, I think there will be a 'Yes' vote, Greece staying in the Euro, further bailout and aid packages, and no more Tsipras. I think, I hope, or do I?! Let's see! Prepare for much more volatility and have your investment portfolios well positioned. There is opportunity and risk, so speak to your Financial Consultants today.

Author: Ian James Pryor is a highly qualified financial planner and investment adviser based in Singapore as the Managing Partner of the Expat Advisory Group at IPP. He has a BA(Hons) in Economics and holds licenses in both Singapore and Hong Kong, as well as professional certification from around the world including the UK. Any views or opinion expressed here is his own and not necessarily representative of IPP. IPP is Singapore's oldest and largest Licensed Financial Adviser, with offices in Singapore, Hong Kong, Malaysia and Vietnam, Assets Under Advisory of $2 billion, and more than 50,000 clients worldwide.

For more information or to request a free consultation, send me an 'InMail' or emailianpryor@ippfa.com. Please visit www.ippfa.com/eag for an overview on IPP and EAG.

Comments